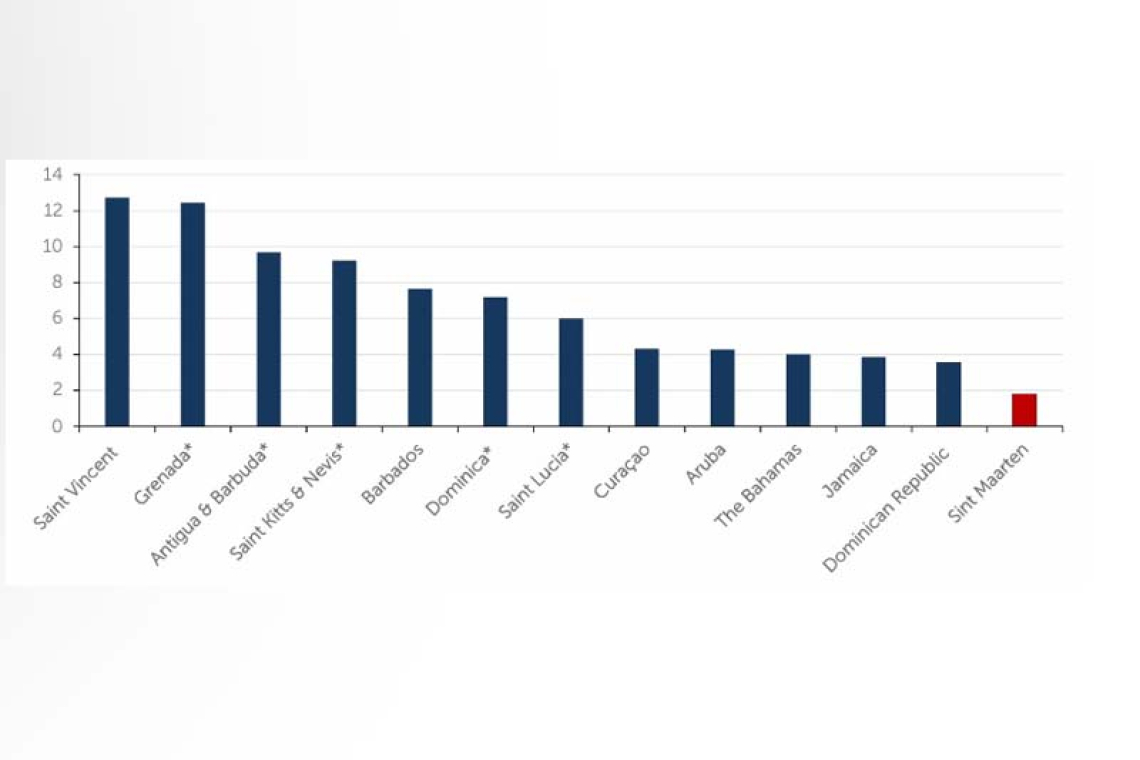

A Central Bank of Curaçao and St. Maarten (CBCS) graph showing the average foreign direct invest-ment (FDI) inflows as percent of gross domestic product (GDP) in tourism-intensive Caribbean coun-tries between 2011 and 2022. The asterisks depict countries with Citizenship by Investment pro-grammes.

PHILIPSBURG--St. Maarten has attracted less foreign direct investment (FDI) since 2011 than other tourism-intensive Caribbean countries, according to a new study by the Central Bank of Curaçao and St. Maarten (CBCS).

Despite having high trade openness and being part of the Kingdom of the Netherlands, St. Maar-ten’s average FDI inflows relative to its gross domestic product (GDP) have been consistently below its regional peers, the report released last week says.

The study suggests that the reason may lie in St. Maarten’s mature position along the tourism life cycle stage, which now limits its ability to attract new large-scale tourism investments. Based on these findings, new policy directions may be needed for St. Maarten, according to its author Jason Lista, an economic analysis and research specialist at CBCS.

Because FDI plays a critical role in Small Island Developing States (SIDS) by generating foreign ex-change earnings, creating jobs, and transferring new technology and skills, it is essential to get the policy mix right to attract and retain capital investment in St. Maarten for the long term, CBCS said.

The new study bridges the gap between conventional FDI studies on one hand, and tourism lifecy-cle dynamics on the other by building on the influential Tourism Area Life Cycle (TALC) model in the context of SIDS like Sint Maarten. It is the first time a study has empirically validated St. Maarten’s tourism statistics according to the TALC, according to CBCS.

“The study reframes the discussion of comparatively low FDI, not simply as a failure of policy or competitiveness, but as a structural characteristic of tourism maturity in specific small island con-texts,” CBCS said. “Recognising this evolution offers both a diagnostic insight and a foundation for more targeted, context-sensitive strategies for investment and development in the decades to come. From a policy perspective, the findings indicate that future FDI attraction strategies must account for this maturity and saturation.”

Policymakers may need to pivot toward reorienting tourism to a more upmarket trajectory and, where possible, promoting diversification into complementary sectors that enhance tourism, CBCS said. “Potential areas for diversification could include infrastructure renewal projects, as well as ma-rine and agrotourism.”

Additionally, strengthening statistical capacity and extending time series data on FDI inflows and fine-tuning tourism statistics to better account for Saint Martin, the French side of the island, will also be essential to refine future empirical research and help inform evidence-based decision-making, CBCS said.

The full working paper is available at www.centralbank.cw/functions/research.