PHILIPSBURG--Construction prices in St. Maarten were expected to rise in 2025, with sixty per cent of firms forecasting residential construction cost increases of at least five per cent and eighty per cent of firms projecting non-residential construction rises of five-fifteen per cent.

This is according to the 2025 construction sector survey conducted by the Central Bank of Curaçao and St. Maarten (CBCS). The survey, carried out among registered construction companies during August and September 2025, provides insights into operational challenges, investment intentions, and expectations for the future.

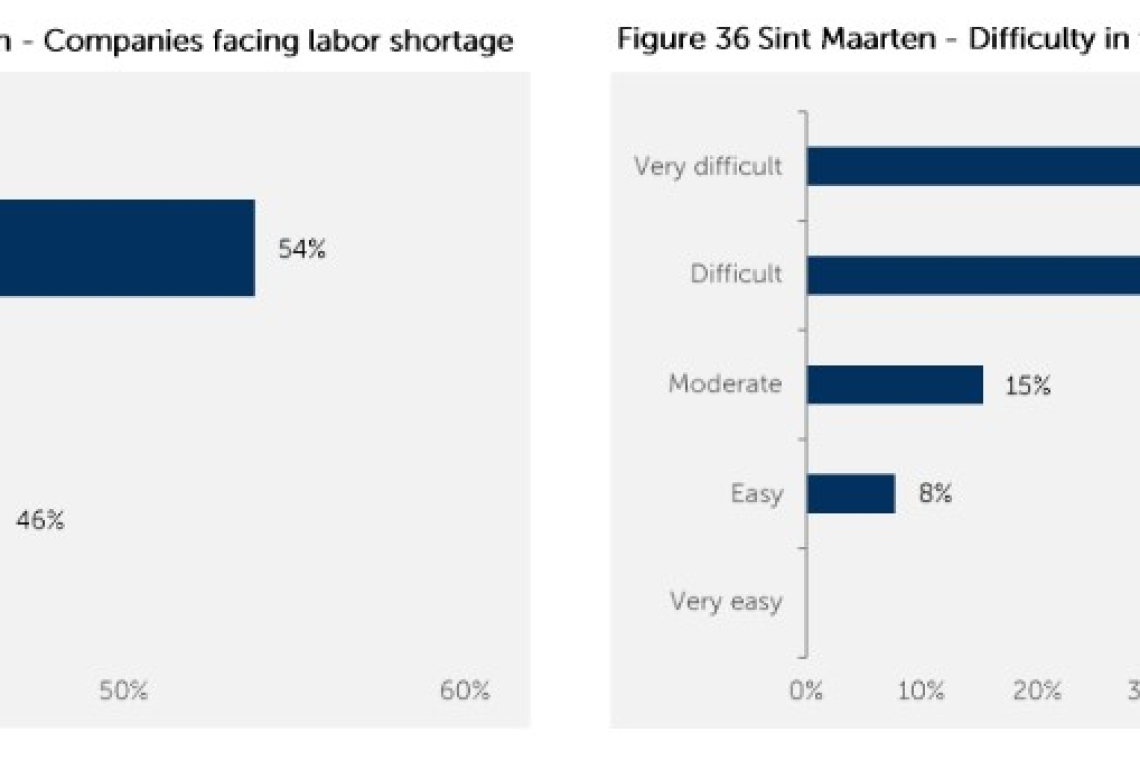

According to the findings of the survey, labour shortages were said to have been severe, with 54% of construction companies reporting difficulty finding workers. Skilled trades such as electricians, plumbers and carpenters are hardest to fill, cited by 69% of firms, while 31% report shortages in site supervisors and foremen.

Most construction firms on the island are small, with 69% employing fewer than five full-time staff, and only 8% operating at medium scale (20-50 employees). The sector is primarily domestic, with 92% serving the local market. However, 46% of firms rely on imported materials and services, highlighting exposure to global supply chain disruptions. Inventory management is project-based, with 54% of firms maintaining less than one month of stock.

Cost pressures intensified in 2025, driven by increasing transportation and material expenses. Half of respondents expect international and local transportation expenses to rise by 10-15% or more, while 20% anticipate smaller increases. Material cost is expected to rise, primarily due to transportation and shipping (50%), rising material prices (50%), and skilled labour shortages (30%). Inflation expectations are strongly tilted upward, with 70% of firms expecting further price increases in 2025.

According to the survey, employment expectations remain largely stable, with 60% of firms forecasting no change in workforce size, 20% anticipating growth, and 40% expecting stability or contraction in market position. Wage expectations are moderate: 60% of companies anticipate no change, while 40% expect increases of 5-15%.

St. Maarten firms remain cautious about the broader economic outlook. Half of respondents expect economic conditions to worsen compared to 2024, 20% anticipate no change, and only 30% foresee improvements. Expectations for the business climate mirror this caution: 40% of firms anticipate deterioration, 40% expect no change, and 20% anticipate improvement. Firms’ own market positions are also affected, with 40% expecting a decline, 30% expecting no change, and 30% anticipating improvement.

The survey found that most companies focus on general construction services for residential and commercial buildings (32%), followed by construction finishing services such as painting and woodworking (21%), installation services including plumbing, electrical, and air conditioning (18%), general infrastructure construction (12%), and equipment rental (12%). Only 3% offer other services such as architecture or interior design.

Investment plans in 2025 reflect caution. Half of firms expect investment levels to decline, 40% anticipate stability, and only 10% expect increases. A large majority (90%) reported no capital investments for the year. Medium-term plans (2026-2030) are also restrained: 56% of firms report no planned capital spending, while 45% anticipate some investment. Of those planning investment, 33% expect less than Cg. 100,000 annually, and 22% project between Cg. 500,000 and Cg. 1 million.

Skilled labour shortages (44%) are the primary challenge, followed by island infrastructure constraints (33%) and rising material cost (22%). No firms listed red tape as a major concern. To improve the business climate, respondents prioritised expanding the skilled labour pool (33%), improving access to credit (33%), reducing red tape (22%), and lowering the cost of doing business (11%).

By contrast, construction firms in Curaçao expressed a more positive outlook, expecting stable or improved economic conditions, moderate employment growth, and rising capital investment. St. Maarten’s cautious sentiment reflects limited capital investment plans, sharper cost increases, and heightened concerns about market prospects.

The 2025 CBCS survey underscores that while St. Maarten’s construction sector remains resilient, it is under pressure from rising construction prices, labour shortages, transportation and material cost increases, and limited access to finance. Expanding the skilled labour pool, enhancing access to credit, and reducing overall business cost will be essential to strengthen competitiveness and support broader economic growth.