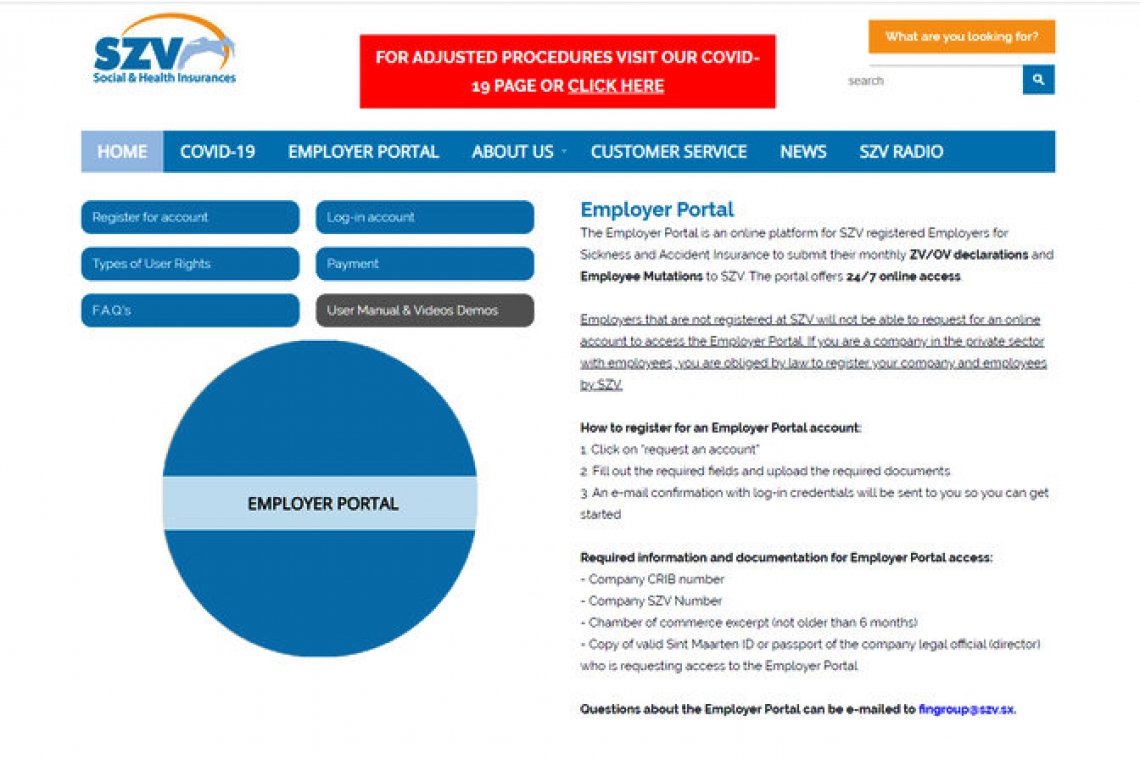

Screenshot of the SZV website page where businesses can apply for government financial assistance.

PHILIPSBURG--Up to yesterday, Friday, a total of 159 businesses had applied for payroll support from government’s St. Maarten Stimulus and Relief Plan (SSRP), Finance Minister Ardwell Irion told Members of Parliament (MPs) late last night, during a parliamentary meeting on the plan.

Of the 159 businesses, 54 were from the wholesale, retail, trade and repair of motor vehicles sector; 42 were from – what the minister referred to as – a “non-classified” sector; 29 from the hotel and restaurant sector; 14 from – what the minister referred to as – [the – Ed.] “other community” category and eight from the transport, storage and communication sector.

Additionally, four [businesses] from the construction and engineering sector registered; four from the healthcare and social work sector; three from the retail, rental and business activities sector and one from the agriculture and landscaping sector.

Also, as of 4:40pm Friday, a total of 800 employers had registered in the Social and Health Insurances SZV portal. Via this portal, employers are able to manage their company information and make changes. SZV has an active employer base of approximately 2,000 businesses. Additionally, the St. Maarten Chamber of Commerce and Industry (COCI) handled about 578 business “excerpts” up to Friday afternoon.

This is one of the documents required to apply for payroll support. The requests were predominantly from jewellery stores, hotels and retail and construction companies, Irion noted.

One MP expressed concern about some businesses informing their workers to apply themselves for payroll support or for unemployment benefits due to audits they will be subjected to if the business were to apply themselves for payroll aid: indicating that this can be a signal of major non-tax compliance.

Irion clarified that employees are not able to apply for payroll support on their own, only employers can apply for their workers. He stressed that if employers were not applying for payroll support due to possible audit they could be subjected to for the purpose of verification of their applications, “this is most concerning.”

During Friday’s meeting, Irion answered the majority of a total of 195 questions posed by MPs during the first round of the meeting. Some of the questions were answered by Minister of Health, Labour and Social Affairs VSA Richard Panneflek.

Irion told MPs that the SSRP was created to mitigate the effects of COVID-19 in the short term. It was not intended to address issues in the long run. He acknowledged that a long-term plan is important and needed and assured that one will be coming. Many countries were also taking short-term measures since without it, their economies will crumble.

He stressed that St. Maarten had to be realistic when it was creating a plan to receive funding from the Netherlands. If government had to pay 100 per cent salaries excluding civil service, it would cost NAf. 62 million guilders per month and NAf. 186 million guilders for three months. This would be for payroll support alone.

The country would then still also need to consider unemployment support and support for independent operators such as vendors and taxi drivers et cetera, and also funds to fight COVID-19 itself. “The amount needed would be significantly high.”

“We have to be realistic with the funds that we have and present a plan that will not be shut down immediately,” Irion noted. The plan is to ensure that persons who are most impacted and the most vulnerable will be supported. “That is why we have payroll support, so that employees will still get some income instead of no income.” He also said that SZV was asked to help since government does not have the necessary mechanisms to execute the initiative.

During this crisis seniors will continue to receive their pensions, but they might be affected by not getting additional benefits or supplements.

The payroll-support programme is available for employers who are already registered at SZV. For those employers whose data requires updating, this can be done via the SZV portal. SZV has a helpdesk and can provide assistance for those who may have difficulty.

Employers that were not registered at SZV as of April 1, are not eligible to apply for the payroll-support programme. The lack of having a crib number will not disqualify an applicant for any of the other programmes.

Persons who are employed and thus registered at SZV on April 1, – regardless of the expiration date of their work contract – could be a recipient through the payroll- support programme if the employer participates in the programme. However, persons whose contracts expire during the programme are considered to have become unemployed under normal circumstances, as the unemployment is not COVID-19 related. Those persons are advised to apply for financial support at the Social Welfare Department.

Also, the payroll-support programme does not discriminate between legal and non-legal residents, it only looks at whether a person is employed and the company that they work for is registered at SZV, amongst the other criteria.

As it relates to workers who earn above the OV/ZV wage limit, Irion said while government will pay up to 80 per cent of the payroll of qualifying businesses with a minimum of NAf. 1,150 for a full- time employee for a maximum period of 3 months; the ZV cap of NAf. 5,651.36 per month will be applied. All employees registered at SZV are included.

As for persons with dual nationality who are registered in both Dutch St. Maarten and French St. Martin, and might want to take advantage of the support programmes on both sides of the island, Irion said the same thing that makes the island unique from a cultural, social and tourism perspective brings complications with it at times like these.

He said the Prime Minister Silveria Jacobs’ office is handling this matter with the French authorities in an effort to prevent and hold persons liable who do abuse this situation.

As it relates to MPs concerns regarding the exempt list of businesses that are excluded from the payroll support, Irion said the list is based on the level of vulnerability of the company. “The methodology is mainly based on the received premium revenue of each sector for the first six months after Hurricane Irma.

“Additionally, we looked at which businesses were allowed to stay open after the partial and subsequently, the total lock down. Please bear in mind that the ideology for providing the assistance is based [on] assisting those most vulnerable in our society. Everyone is suffering. Everyone is losing income or making less income but having limited funds, the focus is on helping those who government can include, who are most vulnerable and not who should be excluded,” Irion explained.

The Stimulus Plan is reflected in the draft 2020 budget, which will be handled in a meeting of the Central Committee of Parliament today, Saturday. The pay out of the payroll support for eligible and approved applicants can start once the budget has been approved.

According to Irion, the bills paid thus far in relation to COVID-19 stands at approximately NAf. 650,000.

In the meantime, Princess Juliana International Airport is no longer included in the stimulus plan for payroll support.