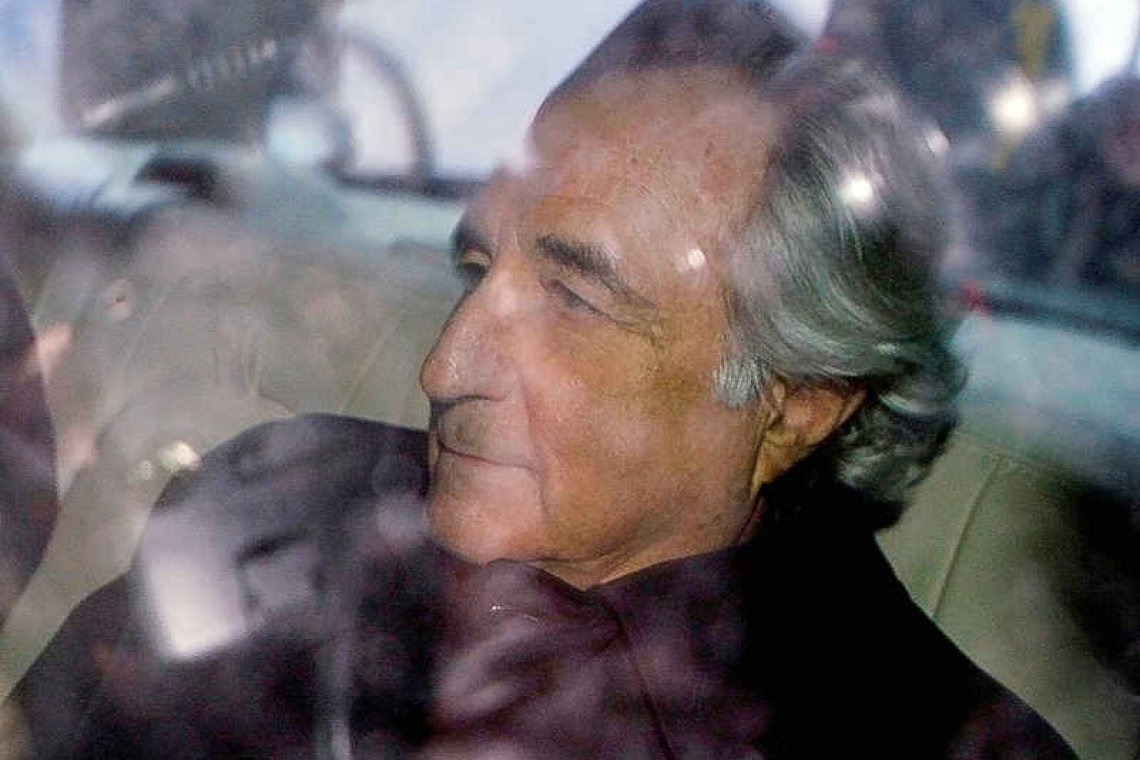

NEW YORK--Bernard Madoff, who for decades masqueraded as a successful and trustworthy Wall Street kingpin before admitting to running the largest known Ponzi scheme in history, died on Wednesday in prison where he was serving a 150-year sentence. He was 82.

A spokeswoman for the Federal Bureau of Prisons said Madoff died at the Federal Medical Center in Butner, North Carolina, about 3:30 a.m. EDT. His death was believed to be from natural causes. Madoff had suffered from terminal kidney disease and several other medical ailments.

Madoff was imprisoned for engineering a fraud estimated as high as $64.8 billion. The judge who sentenced him in June 2009 condemned his crimes as "extraordinarily evil."

In February 2020, Madoff had sought "compassionate release" from prison so he could die at home, but the same judge denied that request. "Bernie, up until his death, lived with guilt and remorse for his crimes," Madoff's lawyer Brandon Sample said in a statement. "Although the crimes Bernie was convicted of have come to define who he was - he was also a father and a husband. He was soft spoken and an intellectual. Bernie was by no means perfect. But no man is."

Madoff concealed his fraud through multiple recessions and the Sept. 11, 2001, attacks, but the 2008 financial crisis proved his undoing, as investors demanded he redeem $7 billion he did not have. His Ponzi scheme made him a poster child for Wall Street greed, shining a harsh light on both his accomplices and on regulators who seemed on the cusp of exposing him, but failed.

In a typical Ponzi scheme, money from newer investors is used to pay sums owed to earlier investors. Madoff was arrested on Dec. 11, 2008, after confessing to sons Mark and Andrew that his investment advisory business had been "one big lie." They revealed the scheme to authorities.

Marc Litt, who led the prosecution of Madoff, said: "His passing closes a dark chapter of deception and greed that irretrievably damaged the lives of tens of thousands of victims. It is unfortunately fitting that he died in jail."

Madoff's thousands of victims, large and small, included individuals, charities, pension funds and hedge funds. Among those he betrayed were the actors Kevin Bacon, Kyra Sedgwick and John Malkovich; baseball Hall of Fame pitcher Sandy Koufax; and a charity associated with director Steven Spielberg.

The former owners of the New York Mets, longtime Madoff clients, struggled for years to field a good baseball team because of losses they suffered. Many victims came from the Jewish community, where Madoff had been a major philanthropist.

"We thought he was God. We trusted everything in his hands," Nobel Peace Prize winner Elie Wiesel, whose foundation lost $15.2 million, said in 2009.

Some victims lost everything. "Bernie Madoff left my life December 11, 2008, when I found out that he stole all my money," said Ronnie Sue Ambrosino, a Surprise, Arizona, resident whose family lost $1.6 million.

Madoff's fraud exposed holes at the U.S. Securities and Exchange Commission, which through incompetence or neglect botched a half-dozen examinations. "There were several times that I met with the SEC and thought, 'They got me,'" Madoff told lawyers in a prison interview, according to ABC News.

Madoff had been the largest market-maker on the Nasdaq, once serving as its non-executive chairman. His brokerage firm was located in a Midtown Manhattan tower known as the Lipstick Building.

Employees there said they felt like part of Madoff's family. They did not know he was running his fraud on a different floor. Only a trusted few did.

Madoff said his fraud began in the early 1990s, but prosecutors and many victims believe it started earlier. Investors were entranced by the steady, double-digit annual gains that Madoff seemed to generate, and which others found impossible to explain or duplicate.

The money helped Madoff and his wife, Ruth, enjoy luxuries such as a Manhattan penthouse, a French villa and expensive cars and yachts, with a combined net worth of about $825 million. But no one from Madoff's immediate family was in the Manhattan courtroom when U.S. District Judge Denny Chin sentenced him.

And no family, friends or supporters submitted letters attesting to his good character or deeds in support of leniency. "I believed when I started this problem, this crime, that it would be something I would be able to work my way out of, but that became impossible," Madoff told the court. "As hard as I tried, the deeper I dug myself into a hole."

Madoff also addressed victims in attendance, saying, "I am sorry. I know that doesn't help you."

Ira Lee Sorkin, a lawyer who had represented Madoff, said they last spoke 1-1/2 months ago. He said that Madoff reported receiving good medical care and that he believed Madoff was remorseful.

“All I can say is it was a great tragedy," he said. "There are no winners in this case, none whatsoever."

The pain for Madoff's family did not end with the patriarch's imprisonment. Tormented by his father's actions and by lawsuits, Mark Madoff, the older son, hanged himself with a dog leash at age 46 on Dec. 11, 2010, the second anniversary of his father's arrest. Andrew Madoff died of cancer in September 2014, at age 48.

When rejecting Madoff's request for compassionate release in June 2020, Judge Chin agreed with prosecutors that prison interviews where Madoff played down his crimes showed he "never fully accepted responsibility" for them. Madoff told New York magazine he believed the record should show he had changed Wall Street, and that many victims might have lost more money in the markets had they not heard of him.

But he said he would not make excuses for his fraud and had come to terms with his crimes and pariah status. "It is what it is," he said.