Graphic outline: The latest data provided by SHTA.

PHILIPSBURG--According to new calculations released by St. Maarten Hospitality and Trade Association (SHTA), only 72 percent of the 473,000 stay-over visitors reported by the Department of Statistics in 2024 appear to have stayed in accommodations on the Dutch side of the island.

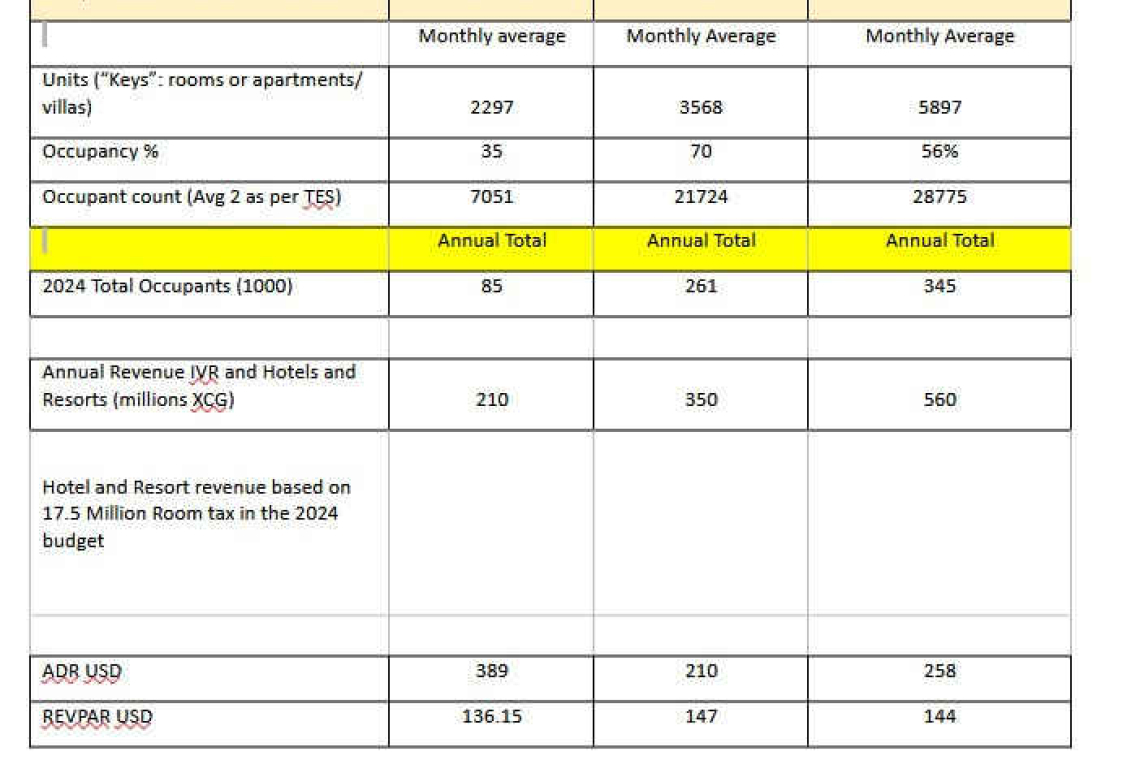

In absolute numbers, this equals about 345,000 visitors making use of either independent vacation rentals (IVRs) or hotels and resorts. Of that total, approximately 85,000 stayed in IVRs while 261,000 lodged in hotels and resorts.

Average monthly occupancy on the Dutch side worked out to 56 percent overall, with vacation rentals averaging 35 percent and hotels and resorts achieving 70 percent.

Together, these visitors generated an estimated XCG 560 million in revenue, of which XCG 350 million came from hotels and resorts and XCG 210 million from vacation rentals. Revenue estimates for hotels and resorts are based on the XCG 17.5 million in room tax included in the 2024 national budget, equating to a revenue per available room (RevPAR) of US $147. Vacation rentals were calculated at a RevPAR of $136.15.

SHTA said the figures highlight how both sectors now play a major role in St. Maarten’s stayover economy, with vacation rentals continuing to expand their share alongside traditional accommodations.

The new calculations follow an earlier joint analysis with data firm Lighthouse, which looked at the island as a whole. That study estimated the IVR market generated about US $319 million in 2024, accounting for more than 5,100 active units across both sides of the island. On that basis, vacation rentals may have equaled, or possibly outpaced, the hotel sector in total contribution when the French side is included.

The trend has been building for several years. In mid-2023, SHTA reported that St. Maarten already hosted 1,301 rental units with 3,357 rooms, nearly matching the 3,368 hotel units with 4,262 rooms on the Dutch side.

According to SHTA, the figures confirm that the growth of short-term rentals is reshaping the island’s tourism economy. Once dominated almost entirely by hotels and timeshares, the stay-over market is now split more evenly between large resorts and smaller, independent operators.