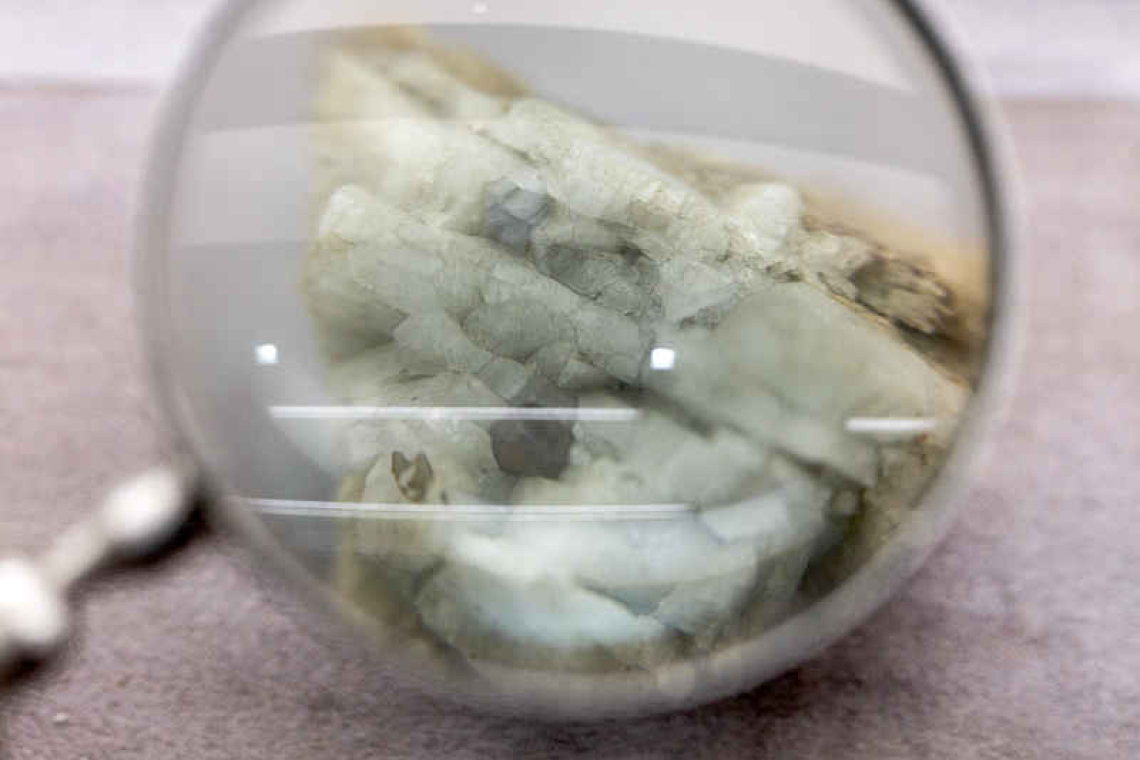

A sample of monazite, a mineral used in the rare earth industry to extract elements such as cerium, lanthanum, and neodymium, is displayed next to a magnification glass at the Geological Museum of China in Beijing, China, October 14, 2025.

BRUSSELS--The EU executive will unveil this week measures to cut the bloc's over-reliance on China for critical raw materials as Europe seeks to keep up with fierce global competition from the U.S. and Asia.

Despite years of warning signs that the old model of rules-based trade was coming to an end, accelerated by U.S. President Donald Trump's return to power, European governments have been asleep at the wheel, EU and industry officials said.

"Europe has become more vulnerable, also due to our dependency on third countries for our security and the supply of critical raw materials," European Central Bank chief Christine Lagarde said last week, citing other challenges ranging from rising U.S. tariffs to stiffening competition from China."Europe’s vulnerabilities stem from having a growth model geared towards a world that is gradually disappearing."

Beijing's threat of new curbs on rare earth exports to the West in October, on top of restrictions announced in April, has caused fresh panic in European car, clean energy and semiconductor sectors all heavily dependent on them. EU's Industry Commissioner Stephane Sejourne said this week Europe was not just a collateral victim of trade tensions between the U.S. and China but "directly targeted".

The Economic Security Doctrine to be unveiled on Wednesday aims to make Europe's industry more self-sufficient and includes a plan for critical raw materials, called ResourceEU - mimicking the RePowerEU scheme of weaning itself off Russian oil and gas.

Yet curbing the EU's dependence on Beijing will be harder than ending its reliance on Russian natural gas. The materials are not easily substitutable like gas, and China is by far the cheapest and dominates both extraction and processing know-how.

Industry and EU officials said the EU will face the problem of how to pay for creating its own, critical raw materials and rare earths industry, often from scratch, from mines to extraction, processing and stockpiling.A quick solution is to immediately allocate 3 billion euros from the EU's budget to the most urgent 25 of the 60 strategic projects in the rare earths and raw materials sector listed by the Commission, one EU official told Reuters.

The 25 projects would produce rare earths, gallium, germanium and lithium, the official said, adding the measures to be proposed should take care of that financing.

But longer term funding remains a challenge. To ensure their investments will pay off, companies seek guaranteed minimum prices or other guarantees - options the Commission is studying.

The EU is looking to the European Investment Bank, owned by EU governments, for funding and to the EU's Global Gateway plan - its version of China's Belt and Road scheme - to invest in projects that would benefit third countries and the EU. The Commission will also include critical raw materials projects as eligible investments for an existing EU Innovation Fund. But industry remains sceptical.

"Time is against the EU. They have been too slow," Mika Seitovirta, an executive at mining firm Sibanye-Stillwater, told Reuters.