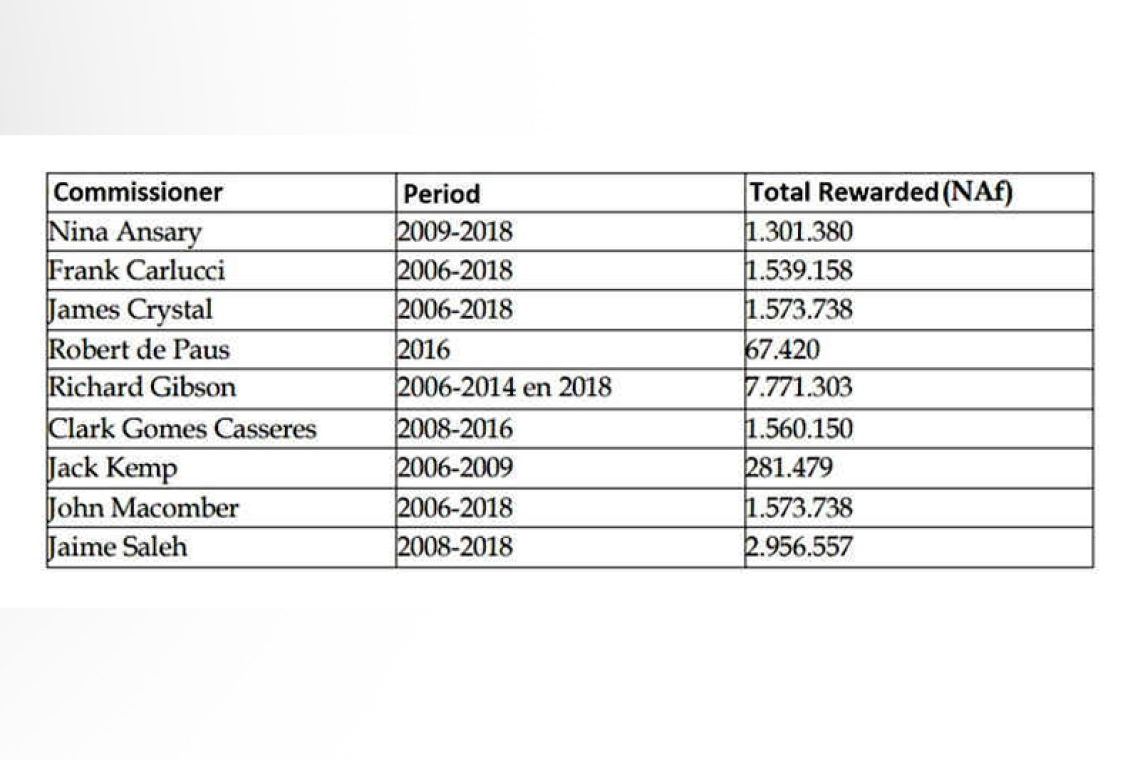

Ennia claims a total of NAf. 18,624,924 has been awarded to supervisory directors in compensation and bonuses, as shown in this table from the judgment of September 12, 2023.

PHILIPSBURG--The Supervisory Board of Ennia Holding, which met three to four times a year, declared NAf. 4,407,177 (US $2.45 million) in travel and accommodation cost for these meetings in the period 2006-2018, or around US $50,000 per meeting. This is part of the NAf. 18,624,924 ($10.35 million) in compensation and bonuses awarded to supervisory board members.

The September 12, 2023, provisional ruling on appeal in the Ennia case lists all rewards and bonuses received by each commissioner, as well as seven ghost commissioners, including former Central Bank of Curaçao and St. Maarten president Emsley Tromp’s son Evan Tromp and former Princess Juliana International Airport Supervisory Board member Clarence Derby.

The first 30 pages of the 143-page judgment establish the facts on the basis of which the court came to the conclusion that the defendants, Ennia director and shareholder Hushang Ansary, his daughter Nina Ansary, and former Ennia directors Abdallah Andraous, Ralph Palm and Gijsbert van Doorn, have caused damage to Ennia and that they are liable to pay damages to Ennia.

“The special duty of care that applies to directors and supervisors of a (life) insurer has not been met, despite very critical observations from within its own ranks and repeated warnings and encouragement from supervisory authority the Central Bank,” the court concluded.

The judges point out that “a director is charged with managing the legal entity and in that context is responsible for the strategic and financial policy to be pursued, the risk policy, the conduct of good administration and compliance with regulations.” When fulfilling his duties, a director must focus on the interests of the legal entity and the company affiliated with it, the court stated.

The judges referred to the Supreme Court, which considered, among other things, in its judgment of April 4, 2014: “When fulfilling their duties, directors must act in the interests of the company and the business affiliated with it. … What that interest entails depends on the circumstances of the case.

“If a business is associated with the company, the corporate interest is generally determined primarily by promoting the sustainable success of this business. … In fulfilling their duties, directors must also exercise due care with regard to the interests of all those involved in the company and its business, partly on the basis of the provisions of Article 2:8 of the Dutch Civil Code [NL].”

In July 2018, at the time of the imposition of the emergency measure by the Central Bank of Curaçao and St. Maarten, the Ennia group of insurers had 50% of the insurance market in Curaçao, St. Maarten, Aruba and Bonaire and 80% of the private pension market in Curaçao.

“This means that many people are dependent on the insurers for their benefits,” the court noted. “Insurers must ensure that sufficient financial resources are available for both the short term (liquidity) and the long term (solvency) to meet their obligations under the agreements with their policyholders, meaning that they can provide insured benefits.”

The court concluded that Ennia rightly blames the defendants for (dividend) payments and for excessive and non-business-related expenditure on, among other things, donations, remuneration of commissioners, private aircraft and compensation to persons not working for Ennia, et al. “The

defendants' defences, including their claim of limitation and discharge, fail on these points,” the court ruled.

Around the time of the takeover of Ennia in 2005/2006, the gross compensation for supervisory directors at Ennia amounted to NAf. 52,780 per year. A memo about the commissioners’ compensation for 2006 states that the existing commissioners, as well as the new commissioners, were to receive an amount of net $6,250 (NAf. 11,375) per quarter. However, after the takeover, the members received significantly more and were also awarded large bonuses.

Ennia Investments paid an average of approximately NAf. 2,000,000 per year for the use of aircraft in the period 2007 to 2017. This concerns two aircraft from the NetJets fleet. NetJets is an American airline that focuses on providing private flights.

On January 31, 2014, an agreement was signed between Ennia Investments and the NetJets group for the purchase of 12.5% of the rights to a Cessna and 12.5% of the rights to a Bombardier. A purchase price of NAf. 4,649,792 was paid for this on December 10, 2014. In the agreement, Ansary is included as “owner’s principle contact” on the part of the NetJets group.

Previously, in 2007 and 2008, Ennia Investments acquired shares in the NetJets group by paying NAf. 9,168,250 ($5,037,500). In addition, Ennia Investments paid an average of approximately NAf. 2,000,000 per year for the use of these aircraft in the period 2007-2017. The invoices show that the flights with the NetJets aircraft were mainly carried out for Ansary until March 2018.

“As far as is known, the NetJets flights were in no way related to Ennia's business operations, let alone that they were necessary for this,” the court stated. “The destinations cannot be reconciled with that.” The flight schedule shows that flights were mainly to American and European cities, as well as to Morocco, Mexico and frequently to the Bahamas.

According to the court, it is reprehensible that Ansary makes private use of an aircraft at the expense of Ennia and – indirectly – policyholders of the insurers, and “was able to fly privately from Curaçao to the United States and Europe at the expense of Ennia. There is simply no conceivable argument that could justify the costs incurred with regard to NetJets.”

The court is of the opinion that no reasonable supervisor would allow or ensure that Ennia Investments pays flight expenses while these are not related to the business operations of Ennia. For the period that they were directors of Ennia Investments, Van Doorn, Palm and Andraous are liable for the damage suffered by Ennia Investments, consisting of the fixed expenses associated with NetJets and the private flights insofar as the expenses have not been reimbursed to Ennia Investments. As (de facto) director, Ansary is liable for this damage, the court stated.

To estimate the correct amount of the damage to be compensated by Van Doorn, Palm, Andraous and Ansary, the court requires a further explanation from Ennia Group of companies of the damage (expenses) per year. The case has been referred to the docket for October 24, 2023, for all parties to respond to what the court has considered.