By BrightPath Caribbean

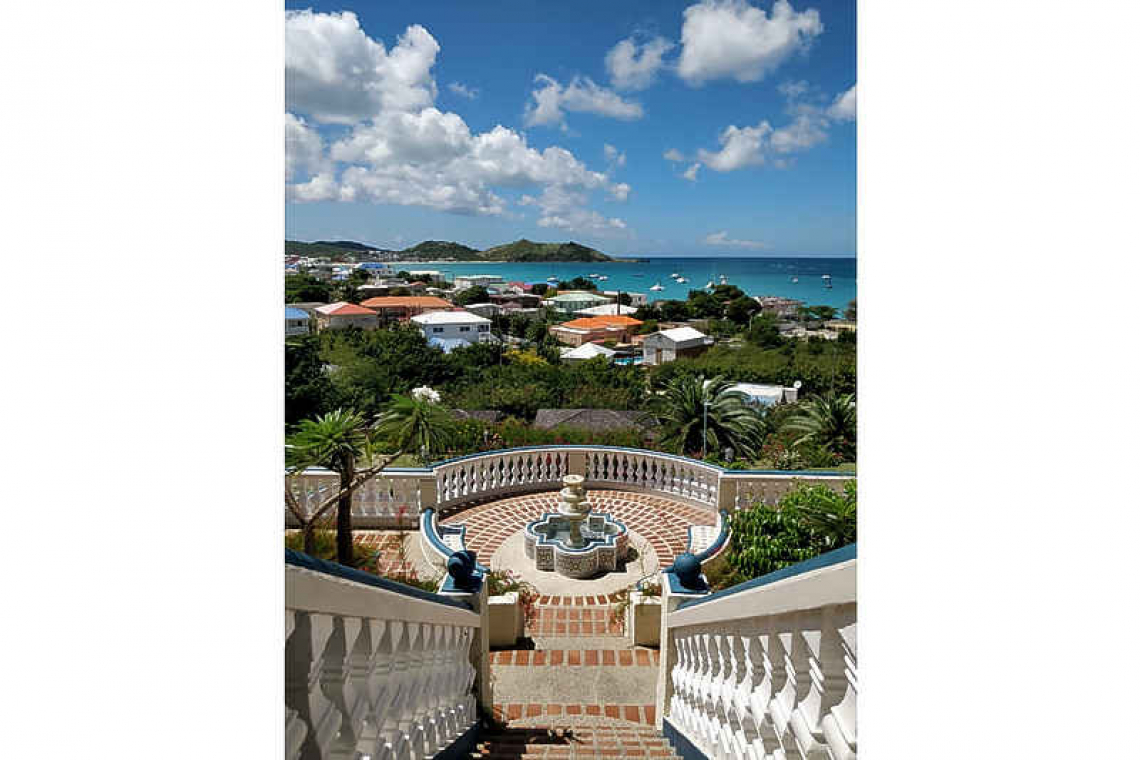

We’ve all been there. It’s likely we’re all still in it. The effects of COVID-19 are still felt in the Caribbean and around the world. Although St. Maarten is certainly not immune to the resulting economic fallout, the island still holds on to the many perks that will likely result in a faster rebound.

Here are our thoughts on why St. Maarten should hold its value and attraction for foreign investors:

1. The island remains a steady income generator in foreign exchange such as US dollars and euros. Although the official currency is the Antillean Guilder, US dollars are widely circulated throughout, with most retailers listing prices in dual currency. Once you have acquired legal residency on the island, you can request your personal bank account in US dollars. Make sure you consult a specialized tax advisor from your country of origin that can further guide you prior to making the decision to obtain legal residency on the island. It helps to be guided by the experts in their respective fields.

2. St. Maarten is still a major import/export hub because of its duty-free status. This last item remains a BIG decision-making factor for expats looking to relocate to the island. Because of the duty-free benefits, expats usually import all their personal belongings, including furniture and vehicles, without having to consider any direct tax implications resulting from this. Also, the accessibility to food items, liquor and other consumables remains at a general par to other more developed countries, precisely because of the duty-free benefits. The volume of consumption is driven not only locally, but also within the region with smaller neighbouring islands procuring from within St. Maarten.

3. Purchasing property is still actively taking place, with property values holding steady. No property taxes are levied on the island and this has made long-time vacation owners and retirees enjoy owning their home on St. Maarten without concerns for direct taxation resulting from appreciating property values. Don’t take our word for it; contact your local trusted realtor of choice, and explore what buying opportunities exist in the market. Who knows? Your next purchase may qualify for legal residency on the island!

For more information on how you can become a legal resident of St. Maarten, contact us at This email address is being protected from spambots. You need JavaScript enabled to view it.

Disclaimer: Our newspaper articles are not intended as (legal) advice and do not take your personal circumstances into consideration. BrightPath does not accept any liability for damages resulting from using the information provided. Before you act or fail to act because of the content of our newspaper articles, we highly recommend you seek personalized advice from us. BrightPath is a privately-owned consulting firm that assists clients with filing applications for residence permits and/or business licenses at the relevant government departments. None of our directors, employees or agents holds or has held any position with the government of Sint Maarten and our service does not provide for any preferential treatment with regard to any application. All information provided and statements made serve only to provide you with a general understanding of immigration, residence and business incorporation procedures on Sint Maarten.

Photo by Aga Sypniewska