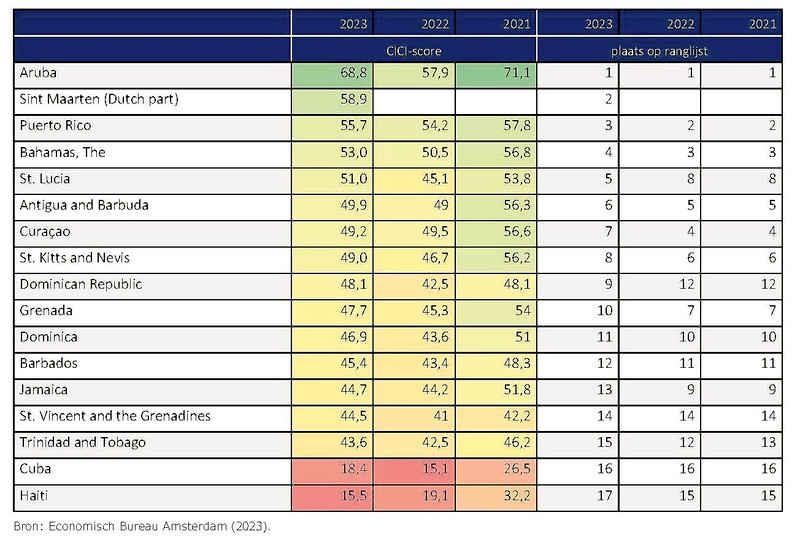

AMSTERDAM--Newcomer St. Maarten on the 2023 Caribbean Investment Climate Index of the Economic Bureau Amsterdam (EBA) conquered second place, right after Aruba. Curaçao placed seventh.

St. Maarten could be included in this year’s index because the availability of country data has improved. The high prosperity level, the resilient economy and the relatively low national debt makes it such that St. Maarten has the second most attractive investment climate of the region.

“St. Maarten has the most open economy of the Caribbean region and even though it makes the country vulnerable to external economic shocks, it creates a strong economic resilience and a growth of the real economy that surpasses the Caribbean average,” it was stated by the EBA on Tuesday.

The population growth is another contributing factor. In comparison to most Caribbean countries, St. Maarten’s population grows, which creates a dynamic on the labour market and limits ageing.

Because the national debt quota is relatively low, St. Maarten has fewer problems with the repression of productive public investments and the insecurity of future policy. According to the EBA, it is important that St. Maarten keeps working on improving the availability of data, since this is still low compared most of the other Caribbean countries.

For the third year, Aruba heads the Caribbean Investment Climate Index with the most attractive investment climate. Of all countries in the region, Aruba is recuperating most strongly from the COVID-19 pandemic.

In 2022, Aruba’s gross domestic product (GDP) was back to the level of before the pandemic and for the coming years, average growth is expected. Many other Caribbean countries are recuperating from the pandemic at a much slower pace.

Aruba has an open economy, which gives the country economic resilience, but it also has a good structural basis due to its strong institutions. The high debt ratio is decreasing due to the strong economic growth and the loan interest is low compared to other Caribbean countries. Aruba’s investment climate can further grow through the reforms of the country package.

Contrary to Aruba and St. Maarten, Curaçao has not seen its investment climate improve with a recovery from the COVID-19 pandemic. Curaçao dropped on the Caribbean Investment Climate Index from fourth place to seventh.

The long-lasting stagnation of Curaçao’s economy as a result of the situation in Venezuela continues to put pressure on the country’s prosperity level. The impact of the pandemic was significant on Curaçao and the recovery is slower than in other Caribbean countries. The very low participation rate and the high debt ratio have an adverse impact on the investment climate.

“The signals are clear that Curaçao needs to accelerate the implementation of the necessary reforms. The permit system needs to change, the population can grow again by allowing foreign workers to come to the island and healthcare and social security need to be urgently reformed in order to structurally improve government finances.”

Puerto Rico placed third, The Bahamas fourth, Antigua & Barbuda sixth and St. Kitts & Nevis eighth. St. Lucia and the Dominican Republic made great strides on the Caribbean Investment Climate Index. St. Lucia placed fifth on the list and the Dominican Republic ninth. Last year, these countries ranked respectively eighth and twelfth.