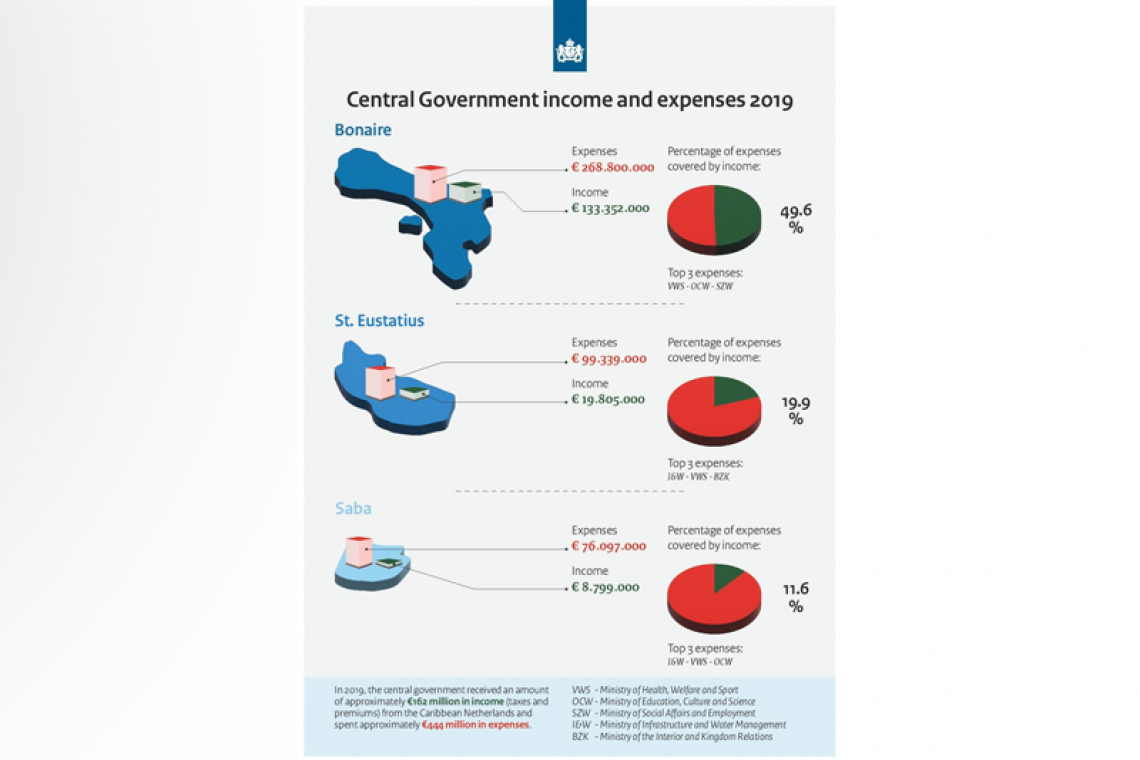

Infographic displaying the central government income and expenses for 2019.

CARIBBEAN NETHERLANDS--In 2019, the central government in The Hague received about 162 million euros in income from the three islands of the Caribbean Netherlands and incurred about 444 million euros in expenditures for the welfare of the inhabitants of Bonaire, St. Eustatius.

This means that 49.6%, 19.9% and 11.6%, respectively, of the central government’s expenditure in Bonaire, Statia and Saba is covered by the income from these islands, State Secretary for Kingdom Relations and Digitisation Alexandra van Huffelen and State Secretary for Taxation and the Tax Office Marnix van Rij wrote Friday in a letter to the Dutch Parliament.

In July 2015, the Ministry of Home Affairs sent an overview to the Dutch Parliament’s Second Chamber with a global breakdown of income and expenditure per island in the Caribbean Netherlands. That overview showed that, respectively, 47.2%, 24.1% and 16.9% of the cash flows to Bonaire, Statia and Saba were covered by national insurance and tax revenues from these islands.

Last year, a request was received from the government commissioner of St. Eustatius for an updated overview of the allocation of income and expenditures. The state secretaries said they granted this request in the interest of transparency. The letter sent to the Dutch Parliament was also sent to the three public entities.

The new overview of government income and spending in Bonaire, Statia and Saba is based on the budget year 2019. This is to provide a realistic image of the distribution of income and expenditure per island, because in 2020 the central government spent about 100 million euros on special support packages because of the coronavirus pandemic. In addition, the central government also received in total some 10 million euros less in taxes and premiums from the Caribbean Netherlands.

Therefore, 2019 gives the most recent, realistic picture of how the expenditures for the Caribbean Netherlands relate to the income received by the government in The Hague from the Caribbean Netherlands, the two state secretaries wrote.

The Tax Office Caribbean Netherlands itemised the income derived from national tax and social insurance contributions for each of the three islands of the Caribbean Netherlands for the year 2019. In total, the tax department received about 162 million euros. In Bonaire US $152 million in taxes and social premiums were collected, in Statia $22.6 million and in Saba $10 million.

For slightly less than half of the expenditures, it was possible to determine exactly what expenses were incurred for which island, Van Huffelen and Van Rij stated. The expenditures for kingdom responsibilities, such as for defence and foreign affairs, were equal to 2014, and not included.

It was decided to also include incidental cash flows – such as the special allowances – to the islands. This could result in a distortion due to, for example, multi-year expenditures in the course of which large amounts did or did not materialise in 2019. An example is the expenditure of the Ministry of Infrastructure and Water Management for the airport in Statia to the tune of 5.9 million euros. However, as was the case for the 2014 overview, the consideration was that not including incidental expenditures would not provide a good image of the total central government expenditure.

The expenditures of the Ministry of Social Affairs and Employment of mainly social benefits and the expenditures of the Ministry of Education, Culture and Science for study financing, were allocated in proportion to the number of inhabitants per island.

This regards, on the one hand, the contributions for the old age pension AOV, the contributions for the social insurances AVV and the income-dependent contribution for the healthcare insurance and, on the other hand, the contributions for employee insurance schemes paid by employers.

Some of the expenditures of almost 53 million euros in total benefited all three islands and could, therefore, not be broken down. This applies, for example, to the police personnel rotation between Bonaire, Statia and Saba. In order to allocate the central government expenditures in the best possible way, the so-called Caribbean Netherlands (CN) key was used for the expenditure that cannot be broken down.

Half of the expenditures is divided equally among the three islands and the other half in proportion to the number of their inhabitants. This stresses that the number of inhabitants is important, but that the small scale of both Saba and Statia causes additional costs compared to Bonaire, which has a larger population.

The Free Allowance is calculated by taking the gross free allowance and adding the additional wage and price-development adjustment LPO. On the basis of all this, it emerged that the central government expenditures in 2019 amounted to 268.8 million euros in Bonaire, 99.3 million in Statia and 76.1 million euros in Saba, or 444.2 million euros in expenditures for these three islands together.

In 2019, by contrast, the central government collected 133.3 million euros in taxes and premiums in Bonaire, 19.8 million euros in Statia and 8.8 million euros in Saba.