PHILIPSBURG--A new study by the Central Bank of Curaçao and St Maarten (CBCS) finds that, in Curaçao, the effects of inflation differ significantly across income groups, with the lowest-income groups experiencing the greatest burden.

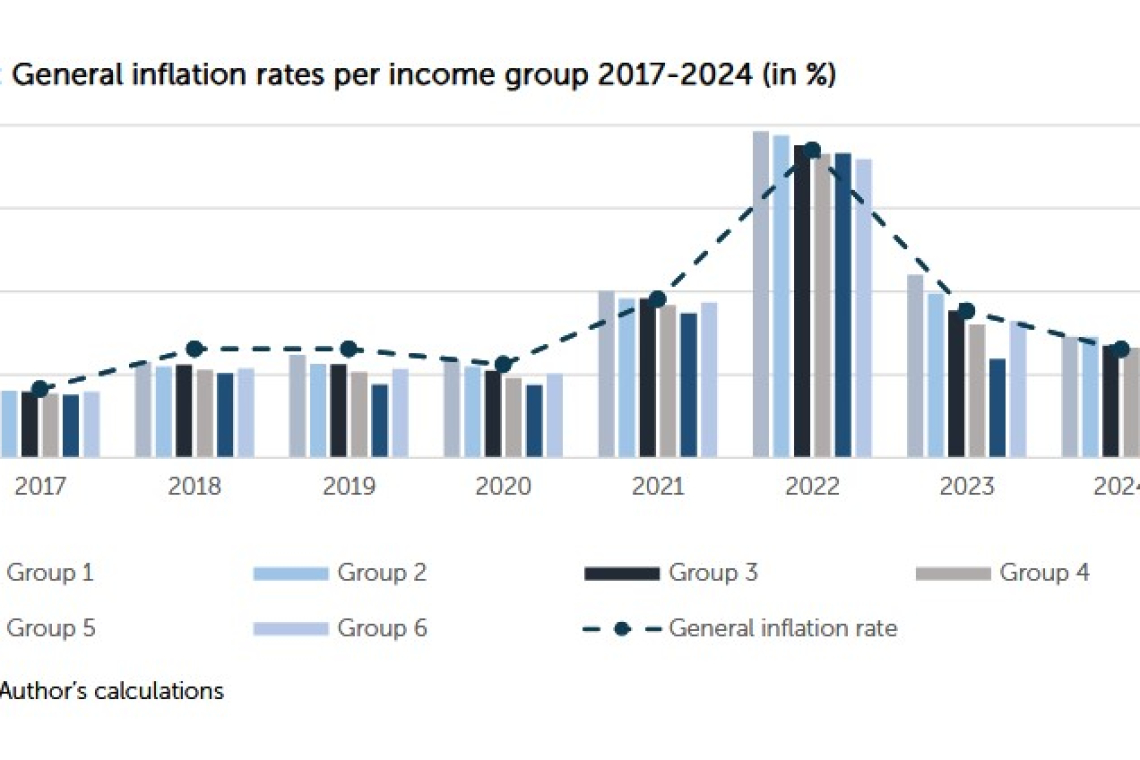

The study, conducted by CBCS Economic Analysis and Research Specialist Robert Hieroms, estimates inflation rates across six income groups over the period 2017-2024. In recent years, rising prices for food, housing, and energy have disproportionately affected households with lower incomes.

“Because food, housing and energy account for a larger share of their consumption basket, even modest price increases erode their purchasing power significantly,” Hieroms explained.

This topic has gained international relevance, as several central banks, including De Nederlandsche Bank (DNB), the European Central Bank, and the U.S. Federal Reserve Bank, have recently conducted similar research on the distributional effects of inflation. The CBCS study follows the methodology of comparable studies conducted in Suriname and Aruba under the Caribbean Economic Research Team (CERT) research agenda.

Between 2020 and 2024, Curaçao experienced several external supply shocks, including the COVID-19 pandemic, supply chain disruptions and the war in Ukraine, that strongly influenced significantly domestic inflation dynamics. Owing to its small size, open economy and high import dependence, Curaçao remains particularly vulnerable to such external price pressures.

While higher prices affect all households, this study examines whether the impact of inflation is uniform or uneven across income groups. Using the Consumer Price Index (CPI) as a measure of inflation, and the household spending data from the Central Bureau of Statistics Curaçao (CBS), the study calculates annual inflation rates per income group. Each group’s expenditure pattern across spending categories is taken into account, allowing for a comparison with the overall inflation rate published by the CBS.

The CBS identified the following six income groups based on their annual household income: Group 1 representing households with annual income up to Cg 24,999, followed by groups 2 and 3 with annual income between Cg 25,000-49,999 and Cg. 50,000-74,999, respectively. Group 4. represents households with annual income between Cg. 75,000-99,999, while group 5 covers annual incomes between Cg. 100,000-124,999. Group 6 represents households with income exceeding Cg. 125,000.

The findings show that the lowest income groups are consistently the most affected by inflation, as almost 60% of their total spending goes to food, electricity, and fuel expenses. In contrast, higher-income groups allocate a smaller portion of their budget to these essentials and tend to record inflation rates below the general inflation rate. This regressive effect of inflation worsens inequality and reduces living standards, particularly during periods of sharp price increases.

CBCS said the study emphasises the importance of targeted policy measures. During periods of external shocks, government measures such as budget support should be carefully designed to assist lower-income groups, rather than implemented as broad, generic policies. Targeted interventions are more effective in protecting the most vulnerable households, who, as this study shows, bear the greatest burden from rising prices.

In addition, to strengthen Curaçao’s resilience against external food and energy shocks, policy-makers are encouraged to invest in local agricultural sector and renewable energy development. These efforts can reduce import dependence and mitigate inflationary pressures in the long term.

The full working paper is available at